Impact Valuation

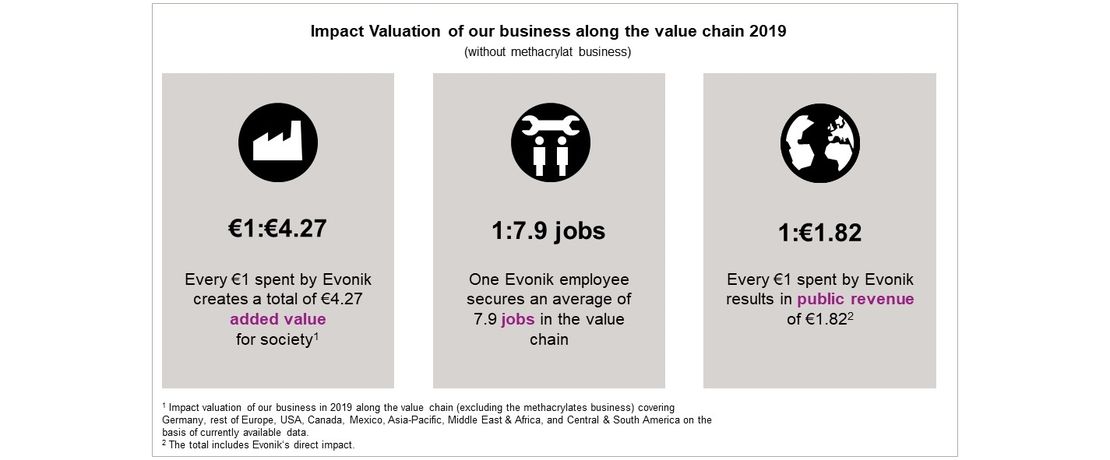

It is important for us as an industrial company to monitor the impact of our business activities intensively. We use an impact valuation to regularly measure and analyze the direct and indirect impacts from an economic, ecological, and social perspective.

The impact valuation supplements our established analytical approaches. We anticipate that this will allow early identification of potential future opportunities and risks, make our business model more resilient, and improve understanding of the long-term value that our business activities create for society.

The impact analysis (Impact Valuation) provides an insight into:

- the scale of the ecological, social, and macroeconomic impact of our corporate activities

- Evonik's benefits to society as a whole

- the key levers to reduce unwanted impacts and maximize desirable impacts along our value chain

Our impact valuation is based on the input-output-outcomeimpact (IOOI) model, which takes account of the input of resources and the measurable outcomes of corporate activity. In addition, short- and long-term impacts are identified, measured along the value chain, and evaluated.

Monetary valuation

We aim to assign a monetary value to individual indicators such as continuing development of employees, employment impacts, and global warming so they can be compared. Most of the factors used for this are publicly available. They are based on the work of well-known economic, environmental, and social research institutes.

Our business activities are associated with ecological impacts at many points. The main negative impacts are greenhouse gas emissions and water consumption in the supply chain. These are countered by strongly positive macroeconomic impacts, both along the supply chain and by our own production activities. In the intermediate term, we want to merge the methodology used in our impact valuation with the sustainability analysis of our business.

You will find more information in our Sustainability Report 2020.