Despite difficult environment: Third quarter better than second

- Adjusted EBITDA in third quarter at €485 million 8 percent higher than in the second quarter

- Cost-cutting measures support operating income and free cash flow

- Technology & Infrastructure division to be split up, administration to be streamlined

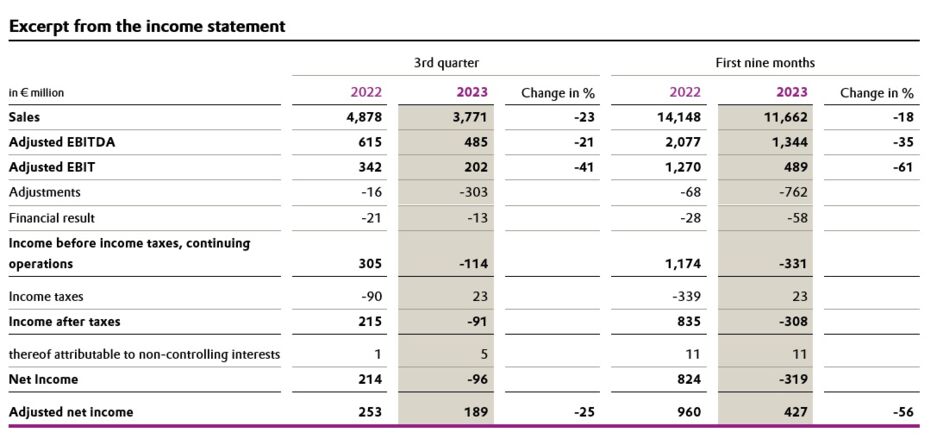

Essen, Germany. Evonik increased the adjusted EBITDA by 8 percent to €485 million in the third quarter 2023 versus the second quarter, also thanks to strict cost discipline. Due to persistently weak demand, the adjusted EBITDA fell by 21 percent year-on-year.

"The economic recovery is still a long time coming," says Christian Kullmann, Chairman of the Management Board. "That is why we are focusing on the levers at our disposal. And that is increasingly having an effect."

Group sales fell 23 percent in the third quarter to €3.77 billion. Sales volumes declined by 5 percent, and prices by 6 percent. For methionine, prices bottomed out in the third quarter and have improved slightly since. The business also realized initial savings effects from the ongoing transformation program of the business line Animal Nutrition.

Free cash flow in the third quarter increased by 63 percent to €469 million, driven by prudent working capital management and investment discipline. Cash generation in the first nine months was also higher than in the previous year, despite significantly lower adjusted EBITDA. Evonik remains committed to increasing the cash conversion rate toward its target of 40 percent in the current year. In 2022, the ratio was 32 percent.

"Our focus on cash is paying off," says Chief Financial Officer Maike Schuh. "We will also benefit from this in the fourth quarter. To strengthen our financial foundation, we will continue to rigorously scrutinizing investments and other expenditures in the coming year."

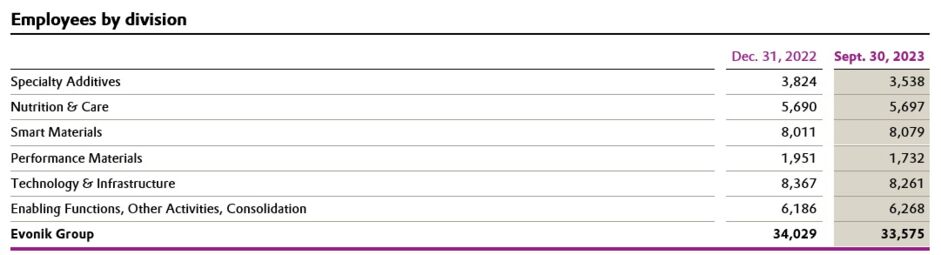

Since the second half of 2022, Evonik has been implementing measures to safeguard earnings, such as not filling vacant positions, not using external service providers and cutting down on business travel. As of September 30, the company had already saved about €175 million, which amounts to 70 percent of the €250 million savings target for 2023. Fixed costs for the Group are now clearly below the level of the previous year. The measures will continue in 2024.

Evonik generated a net loss of €96 million in the third quarter. This resulted from weaker business performance and impairment losses. Evonik realized a €233 million impairment on Superabsorbents ahead of the planned divestment of the business. In 2022, the Group earned €214 million in the same period.

In September, Evonik sharpened its corporate strategy: Two major units are being strategically reorganized to focus resources more closely on the operating business of the three growth divisions. The Technology & Infrastructure Division is being split up. In the future, the Technology Division will benefit from a global pooling of competencies independent of locations. The chemical parks in Marl and Wesseling, Germany, as well as in Antwerp, Belgium run by the Infrastructure Division will become legally independent. The aim is to improve financing options so that the infrastructure of the sites will remain high quality.

Less complexity and clearer responsibilities will be brought about by Evonik Tailor Made. The program will create an administration tailored to Evonik’s specific needs: A new organizational design will enable faster decisions and more efficient processes. This will make the administration more cost-efficient, partly by removing management layers.

Evonik continues to invest in sustainable products: In September, Evonik announced another expansion of production capacity in Schoerfling, Austria. The membrane modules manufactured there can efficiently separate biogas or hydrogen from gas mixtures.

Evonik assumes continued weak demand without recovery for the remainder of the year and confirms the outlook issued in August. Full-year adjusted EBITDA for 2023 is expected to be between €1.6 billion and €1.8 billion on sales of €14 billion to €16 billion. Evonik will limit capital expenditures to around €850 million in the current year.

Development in the divisions

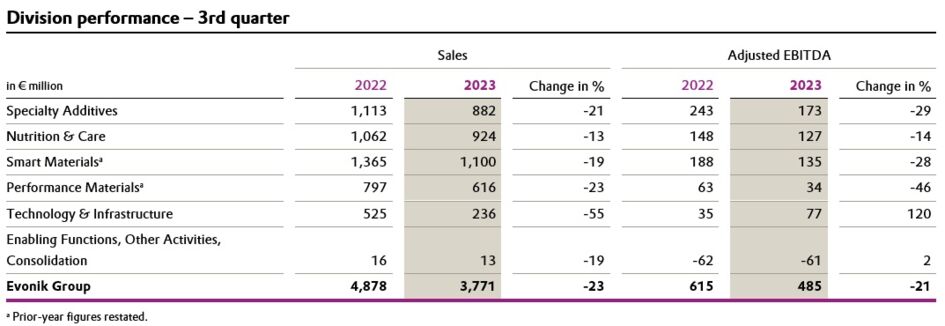

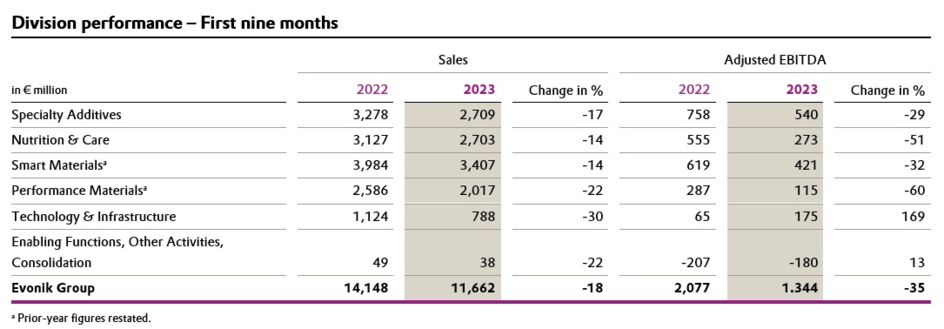

Specialty Additives:

Third-quarter sales in the Specialty Additives division decreased by 21 percent to €882 million. The decline resulted from lower volumes, negative currency effects, and falling selling prices. The prior-year figure also included sales from the TAA derivatives business, which was divested at the end of 2022. Products for the construction and coatings industry saw softening demand in all regions and slightly declining selling prices, generating significantly lower sales. Sales of additives for polyurethane foams and consumer durables also declined due to lower volumes and softening selling prices. Additives for the automotive sector recorded lower volumes, while selling prices declined slightly due to the passing-on of lower raw material costs. Adjusted EBITDA was 29 percent below the prior-year figure at €173 million. The adjusted EBITDA margin fell to 19.6 percent from 21.8 percent in the prior-year quarter.

Nutrition & Care:

Sales in the Nutrition & Care division declined by 13 percent to €924 million in the third quarter of 2023 despite an increase in demand. This was due to lower selling prices than in the prior-year quarter and negative currency effects. The essential amino acids business (Animal Nutrition) registered higher demand, while selling prices remained significantly below the prior-year quarter, causing sales to decline. Products for the health care industry (Health & Care) were in good demand overall, with rising selling prices. Sales declined mainly due to currency effects. Adjusted EBITDA remained 14 percent below the comparable figure for the prior-year quarter. The adjusted EBITDA margin fell slightly to 13.7 percent from 13.9 percent in the prior-year quarter.

Smart Materials:

Sales of the Smart Materials division decreased by 19 percent to €1,100 million in the third quarter of 2023. The decline resulted from lower volumes, negative currency effects and softening selling prices partly due to the passing-on of lower raw material costs. Inorganic products saw significantly lower sales because of declining demand. The lower selling prices reflect the softening in raw material costs. In Polymers, High Performance Polymers benefited from the availability of the two production facilities for polyamide 12 following maintenance work in the second quarter. Sales were roughly level with the previous year. Adjusted EBITDA declined by 28 percent to €135 million. Lower volumes and prices were the main contributors, while lower variable costs had a counteracting effect. The adjusted EBITDA margin fell to 12.3 percent from 13.8 percent in the prior-year quarter.

Performance Materials:

In the Performance Materials division, sales fell by 23 percent to €616 million in the third quarter of 2023. Lower volumes and prices as well as negative currency effects contributed to this. The prior-year figure included sales from the Luelsdorf site, which was sold effective June 30, 2023. Business with products from the C4 chain (Performance Intermediates) recorded stable volume demand, but sales declined as a result of noticeably lower prices. Sales of superabsorbents were also below the prior-year level due to lower demand from Europe. Adjusted EBITDA fell by 46 percent to €34 million. The adjusted EBITDA margin decreased to 5.5 percent from 7.9 percent in the prior-year quarter.

Company information

Evonik is one of the world leaders in specialty chemicals. The company is active in more than 100 countries around the world and generated sales of €18.5 billion and an operating profit (adjusted EBITDA) of €2.49 billion in 2022. Evonik goes far beyond chemistry to create innovative, profitable, and sustainable solutions for customers. About 34,000 employees work together for a common purpose: We want to improve life today and tomorrow.

Disclaimer

In so far as forecasts or expectations are expressed in this press release or where our statements concern the future, these forecasts, expectations or statements may involve known or unknown risks and uncertainties. Actual results or developments may vary, depending on changes in the operating environment. Neither Evonik Industries AG nor its group companies assume an obligation to update the forecasts, expectations or statements contained in this release.