Evonik raises outlook significantly after second quarter results

Key Financial Data: April 1 to June 30, 2024

- Final figures confirm: Adjusted EBITDA in second quarter clearly above previous year and above first quarter

- Free cash flow again positive

- New outlook: adjusted EBITDA €1.9 billion - €2.2 billion

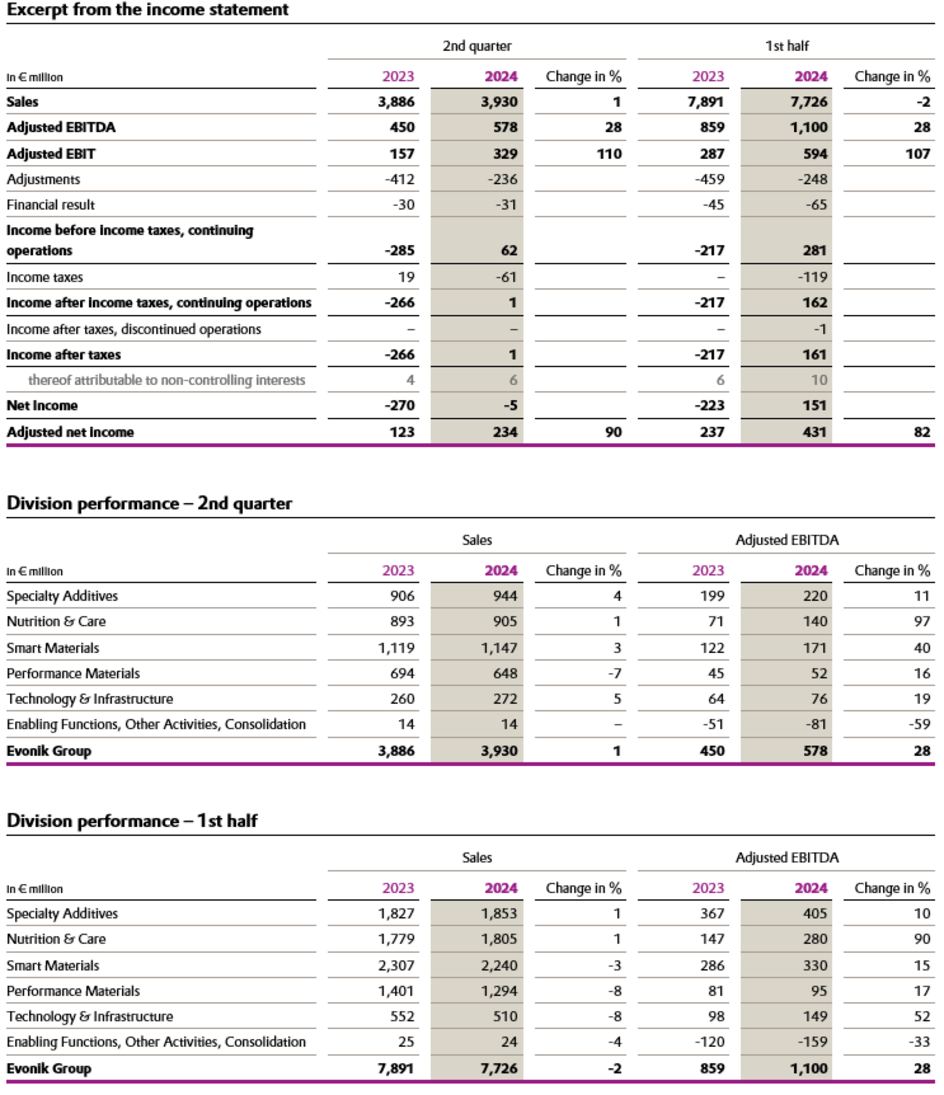

Essen, Germany. Evonik significantly increased its earnings in the second quarter of 2024 despite a persistently difficult economic environment. The final figures confirm the preliminary data announced on July 15: adjusted EBITDA rose by 28 percent to €578 million compared to the previous year. Free cash flow was clearly positive at €217 million, following a cash outflow of €203 million a year earlier.

“We are cutting our costs and doing our homework - and it shows,” says Chief Executive Officer Christian Kullmann with regard to the ongoing restructuring programs. “We have to rely primarily on ourselves at the moment, as there is no real tailwind from the economy.”

Group sales in the second quarter rose by 1 percent to €3.93 billion compared to the same period last year. Prices fell by 2 percent, partly due to the passing on of lower raw material costs. By contrast, prices in the Animal Nutrition business continued to recover. Evonik was able to increase sales volumes by 5 percent. The positive volume development in Specialty Additives stood out, boasting double-digit growth rates. In addition to continued strict cost discipline, lower production costs also contributed to the improvements. The adjusted EBITDA margin rose by 3.1 percentage points to 14.7 percent.

“We are headed in the right direction, and the improvements in our key financial figures compared to the previous year are really encouraging,” says Chief Financial Officer Maike Schuh. “However, the current recovery compares to a very weak 2023, and we are still a long way from reaching our goals.”

On July 15, Evonik raised its outlook for adjusted EBITDA in 2024. The company now expects the measure in a range between €1.9 billion and €2.2 billion (previous range: €1.7 billion to €2.0 billion). The outlook for the other key financial figures remains unchanged: Sales should reach between €15 billion and €17 billion. Evonik anticipates a cash conversion rate of around 40 percent and a significantly higher ROCE. For the third quarter, Evonik expects adjusted EBITDA to be on par with the second quarter.

The Evonik Tailor Made efficiency program will contribute initial savings from the end of this year. Negotiations on the framework for socially responsible job cuts in Germany have been concluded. Evonik recognized provisions of €238 million in the second quarter to implement these reductions. Excluding the provisions, general administrative expenses in the first half of the year were already down 5 percent compared to the previous year. The provisions are also largely responsible for the negative net income of € -5 million for the second quarter. In the same quarter of last year, the net loss amounted to € -270 million.

Evonik continues to develop its product portfolio in a clear direction. The inauguration of the world's first plant for sustainable biosurfactants on an industrial scale in Slovakia shows how Evonik is driving the green transformation in the cleaning, beauty and personal care industry. Evonik wants to be a leader in this market segment, which has a long-term sales potential of €1 billion. The plant in Slovenská Ľupča is expected to be operating at full capacity by the end of 2026.

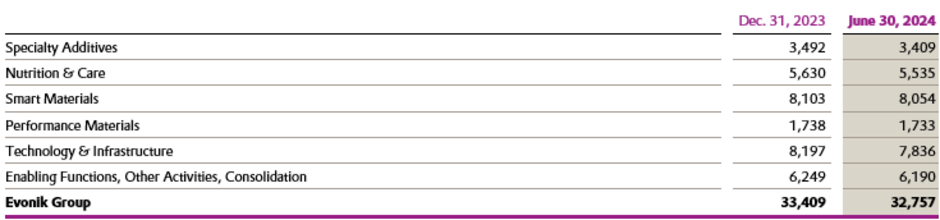

The sale of the superabsorbents business is expected to be completed in the current third quarter. Two of the three business lines that used to form the Performance Materials division will then have a new owner.

Development of the chemical divisions

Specialty Additives: Sales in Specialty Additives rose by 4 percent to €944 million in the second quarter of 2024, driven by noticeably higher volumes. Sales prices declined, primarily because of passing on lower raw material costs and slightly negative currency effects. Products for the paints and coatings industry recorded noticeably higher volume demand, particularly from Europe and Asia, and achieved higher sales than in the previous year. Additives for polyurethane foams and consumer durables achieved slightly higher sales despite falling prices due to rising volumes. Additives for the automotive sector generated noticeably higher sales than in the previous year on increased volumes worldwide. Crosslinkers also recorded noticeably higher demand, although sales remained below the previous year's figure due to falling prices. Adjusted EBITDA increased by 11 percent to €220 million thanks to the increase in volumes, the resulting higher plant utilization, and lower raw material costs. The adjusted EBITDA margin improved from 22.0 percent in the same quarter of the previous year to 23.3 percent.

Nutrition & Care: In Nutrition & Care, sales increased by 1 percent to €905 million in the second quarter of 2024. The results of higher sales prices and positive currency effects were largely offset by declining volumes. The essential amino acids business (Animal Nutrition) benefited from rising prices, while volumes were down compared to the previous year due to an expansion shutdown in Singapore. Overall, sales increased. Health & Care achieved sales almost on par with the previous year. Adjusted EBITDA for the division increased by 97 percent to €140 million ─ primarily due to higher sales prices for essential amino acids and cost savings from the optimization of the Animal Nutrition business model. The adjusted EBITDA margin improved significantly from 8.0 percent to 15.5 percent.

Smart Materials: Sales in the Smart Materials division increased by 3 percent to €1,147 million in the second quarter of 2024. The increase was the result of higher volumes, while selling prices declined, primarily due to the passing on of lower raw material costs. Inorganic products increased sales due to higher volume demand. Polymers were able to significantly increase their sales volumes and sales rose. In the previous year, a planned maintenance shutdown at the polyamide 12 production site negatively affected results. Adjusted EBITDA rose by 40 percent to €171 million, primarily as a result of higher volumes and lower variable costs. The corresponding margin increased from

10.9 percent to 14.9 percent.

Performance Materials: At €648 million, sales of Performance Materials in the second quarter of 2024 were 7 percent below the previous year's figure, which included sales from the Luelsdorf site, divested on June 30, 2023. Products from the C4 chain (Performance Intermediates) generated noticeably higher sales thanks to increased volume demand and improved sales prices. Sales of superabsorbents declined. Adjusted EBITDA increased by 16 percent to €52 million because of higher volumes and lower variable costs. The adjusted EBITDA margin rose from 6.5 percent to 8.0 percent.

Company information

Evonik is one of the world leaders in specialty chemicals. The company is active in more than 100 countries around the world and generated sales of €15.3 billion and an operating profit (adjusted EBITDA) of €1.66 billion in 2023. Evonik goes far beyond chemistry to create innovative, profitable, and sustainable solutions for customers. More than 33,000 employees work together for a common purpose: We want to improve life today and tomorrow.

Disclaimer

In so far as forecasts or expectations are expressed in this press release or where our statements concern the future, these forecasts, expectations or statements may involve known or unknown risks and uncertainties. Actual results or developments may vary, depending on changes in the operating environment. Neither Evonik Industries AG nor its group companies assume an obligation to update the forecasts, expectations or statements contained in this release.