Know the cash flow

Free cash flow is an important indicator of a company’s resilience. In order to improve forecast accuracy for incoming payments from customers, Evonik has developed an artificial intelligence (AI) model.

A QUESTION FOR MS. WOLF, CFO OF EVONIK

A high Free Cash Flow ensures our ability to act, especially in times of crisis, and is an expression of our resilience – our robustness. Even in the volatile times of the Corona pandemic, our high forecasting quality enabled us to react to negative developments in good time. Eventually, we were even able to increase our Cash Conversion Rate and the absolute Free Cash Flow.

Two is better

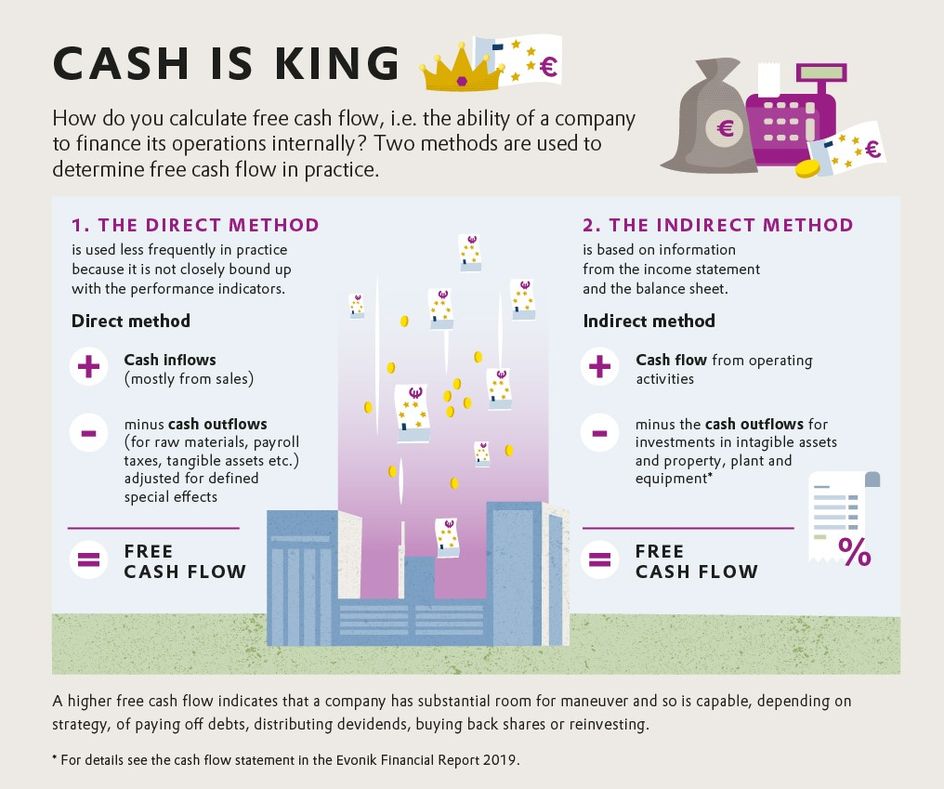

Like many other companies, Evonik has been using the common indirect method to forecast free cash flow, which is suitable for quarterly and annual forecasts. To bring more accuracy into the forecast, Evonik has also set up a direct method to make predictions. “The direct one is based on payments made and can bring more transparency and accuracy, especially for short-term forecasts and analysis,” explains Xuwei Shang, Head of Financial Controlling at Evonik Finance. Both forecasting techniques have their justifications and complement one another.

Greater Precision

The direct method takes into account all operative cash flows within Evonik: customer payments, vendor payments, taxes, payroll, and many more. That affects several units: Accounting, Finance, Procurement, Taxes, Controlling and HR. “That’s why the direct method of determination has been developed by all of them together,” says Shang, who considers it evidence of good cooperation between all the units of Function Finance that are involved. “One ongoing task is to continually optimize the partial forecasts,” he adds. The forecasting of the incoming customer payments is one example of a success. Its accuracy has been significantly improved with the help of machine learning and artificial intelligence.

Who pays when?

When it comes to short-term cashflow forecast, cashflow needs to be broken down on a daily basis. Knowing the exact day of cash-in and -out is essential. While the outgoing payments such as HR and tax are fairly foreseeable, forecasts of customer payments are a big challenge: Customers have different payment behaviors, and they change over time. From this standpoint, it was very difficult to accurately predict the short-term incoming payments.

The agile way to achieve a goal

In 2018, a project was initiated that aimed to use cutting-edge artificial intelligence methods to improve the forecast of incoming payments. Data scientists, IT experts and Finance departments at Evonik jointly formed a lean project team. The question was, as Shang recalls: “Can the AI model predict the future payment behavior of a customer based on historical data?“ As they address the issue, all the core team’s members have a clearly defined role, and they are able to make joint decisions quickly. Each member acts as a contact point for his or her focus area, should the core team require information from the specialized departments.

95 percent accuracy

The small team met daily and initially asked themselves: “What logic do the payment processes at customers follow?” says Shang, explaining the approach, “And how can we anticipate this logic?” The team created an individual matrix for every customer, and the accuracy of the AI model’s predictions gradually increased. The model, which required constant training, used machine learning to get positive results: “We were able to significantly improve the prediction accuracy and now achieve accordance of about 95%,” reported Arpan Seth, the data scientist responsible for the effort at Evonik Technology & Infrastructure. And IT expert Teodora Terzieva in Evonik Product Line Enterprise Analytics adds: “This is a great team effort and has significantly improved our short-term forecast for incoming payments.“