Evonik sells stake in Synoste to Globus Medical in successful venture capital exit

Evonik Venture Capital has sold its stake in Synoste Oy to Globus Medical.

- Stake in Finnish medical technology start-up sold after 4 ½ years of fruitful collaboration

- Partnership gave Evonik further insights into medical applications for its high-performance polymers

- Sale of minority stake to Globus Medical offers attractive financial return on initial investment

Essen, Germany. Evonik Venture Capital has sold its stake in Synoste Oy to Globus Medical. Evonik’s four-and-a-half-year partnership with the Finnish start-up was beneficial to both companies, supporting the development of Synoste’s technology for orthopedics and giving Evonik further insights into the medical applications market for its high-performance polymers. U.S. based Globus Medical acquired all shares. For Evonik the sale represents an attractive financial return on the initial investment.

“The partnership between Evonik and Synoste bore fruit both strategically and financially and is a great example of why we invest in start-ups,” said Bernhard Mohr, head of Evonik Venture Capital. “We are now pleased to hand over to Globus, confident that it is the right owner to support Synoste’s further development.”

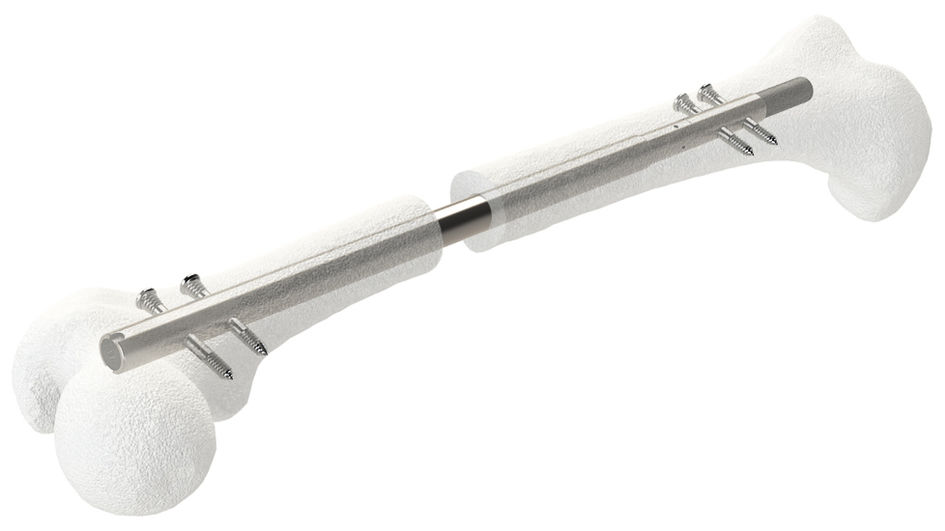

Synoste, based in Espoo, Finland, developed a high-tech implant for a minimally invasive treatment of leg length discrepancy, which can lead to chronic back pain and osteoarthritis in the long term. The bone of the shorter leg is lengthened in a gentle way over a period of several months. The Evonik material used in the implant is a high-performance polymer called polyetheretherketone, or PEEK. The material is biocompatible - not harmful or toxic to living tissue – and has excellent mechanical properties. For the patient the implant represents easier treatment with less pain and lower risk compared to previously established methods.

“The cooperation was very successful with Evonik supporting us in the development of our products and the growth of the company as a whole,” said Harri Hallila, managing director of Synoste.

Since Evonik Venture Capital’s first investment in Synoste in December 2015, Evonik’s High Performance Polymer business line has worked with the start-up to develop the best design for the implant, in which PEEK encases the electronics of the remotely controlled lengthening device.

“The deeper understanding of requirements for medical devices and of the regulatory approval process will help us with future projects,” said Marc Knebel, head of Medical Systems at the High Performance Polymers business line. “We are excited about other potential medical applications for PEEK, which has the ideal properties to replace ever more metal implants.”

Globus Medical, based in Audubon, Pennsylvania, USA, is a leading medical device manufacturer. The company was founded in 2003 with the goal of improving the quality of life for patients with musculoskeletal disorders, which are injuries and disorders that affect the human body’s movement or musculoskeletal system such as bones, muscles, tendons and ligaments.

Company information

Evonik is one of the world leaders in specialty chemicals. The company is active in more than 100 countries around the world and generated sales of €13.1 billion and an operating profit (adjusted EBITDA) of €2.15 billion in 2019. Evonik goes far beyond chemistry to create innovative, profitable and sustainable solutions for customers. More than 32,000 employees work together for a common purpose: We want to improve life, today and tomorrow.

About Evonik Venture Capital

With a fund size of €250 million, Evonik Venture Capital (EVC) has made more than 30 investments since 2012, both direct and fund investments. EVC has offices in Germany, the U.S.A. and China and invests in innovative technologies and disruptive business models in the fields of Nutrition & Care, Specialty Additives and Smart Materials, as well as enabling digital technologies. The EVC team of experienced investment managers provide portfolio companies comprehensive support. The investment scope ranges from early stage to growth stage with investment volume per portfolio company of up to €15 million.

Disclaimer

In so far as forecasts or expectations are expressed in this press release or where our statements concern the future, these forecasts, expectations or statements may involve known or unknown risks and uncertainties. Actual results or developments may vary, depending on changes in the operating environment. Neither Evonik Industries AG nor its group companies assume an obligation to update the forecasts, expectations or statements contained in this release.