Evonik shows solid performance in a challenging environment

- Revenue up thanks to higher prices

- Earnings outlook for 2022 confirmed

- Cost reduction measures prepared for 2023

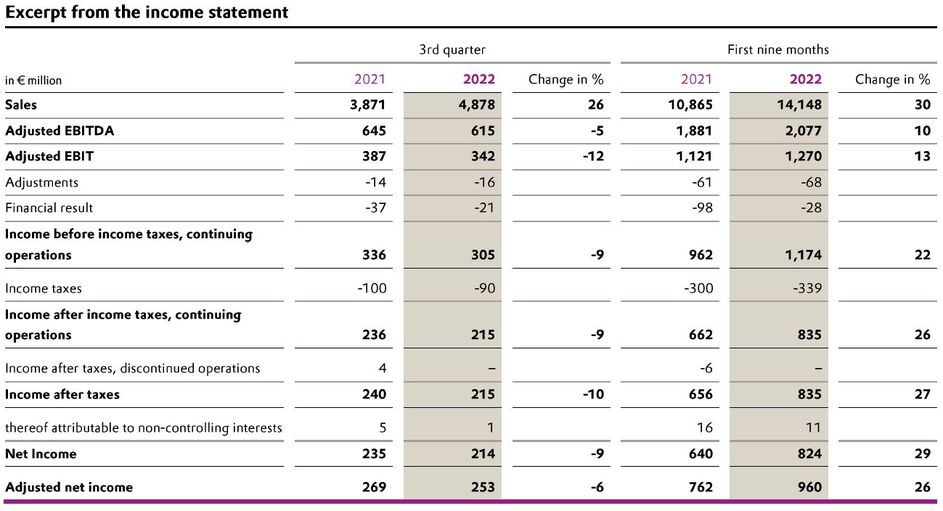

Essen, Germany. Against the backdrop of a clearly weakening economy Evonik showed a solid performance in the third quarter. Although sales volumes sold declined, revenues increased by 26 percent year-on-year to €4.88 billion due to price increases. That way, higher variable costs were successfully passed on. Adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) only declined by 5 percent to

€615 million.

"Despite the increasingly difficult environment, we remain confident of achieving our outlook for the full year," says Christian Kullmann, Chairman of the Executive Board. "At the same time, we are preparing for a recession in the coming year." Corresponding measures, such as restrictions on business travel and trade shows, cutting down on the use of external consultants and disciplined hiring, should help reduce costs in the three-digit million-euro range next year. Implementation is deliberately meant to be decentral and flexible, so the company can react to the volatile economic situation.

Evonik confirms the outlook for adjusted EBITDA in the range of €2.5 to €2.6 billion. Sales in the current year are now expected to be €18.5 billion.

Free cash flow significantly improved compared with the negative €106 million generated in the first half and stood at €288 million in the third quarter. "We have achieved a lot in improving that measure, and the fourth quarter should be even better,” says Chief Financial Officer Ute Wolf. “We are working hard to achieve our goal of a free cash flow conversion rate of about 30 percent."

Evonik has managed to make its energy mix less dependent on natural gas. At its largest site in Marl, Germany, the newly built gas-fired power plant can now be operated with liquefied petroleum gas. At the same time, an extension of the operating license of the coal-fired power plant on site ensures power supply. Other production facilities are also cutting down on gas consumption.

Evonik is also becoming less dependent on fossil fuels: The specialty chemicals company recently concluded a long-term power purchase agreement with German energy supplier EnBW for the offshore wind farm "He Dreiht". Evonik will purchase 100 megawatts green electricity from the new wind farm located in the North Sea for 15 years. Therefore, approximately one quarter of Evonik’s electricity needs in Europe will be met by wind power from 2026 onwards. The parties signed the corresponding contracts last week.

Evonik is also pushing ahead with the revamp of its portfolio, concentrating on specialty chemicals. In August, it sold its betaine business in the U.S., followed by the recent sale of the TAA derivatives business.

Evonik also continues to invest in organic growth: In Mobile, Alabama, it is spending €150 million on a new plant to produce methyl mercaptan, an important intermediate for methionine. In Lafayette, Indiana, the construction of a new plant for pharmaceutical lipids, mostly for mRNA medical applications, will start shortly. In Slovakia, a new facility to produce rhamnolipid biosurfactants is underway.

Development in the divisions

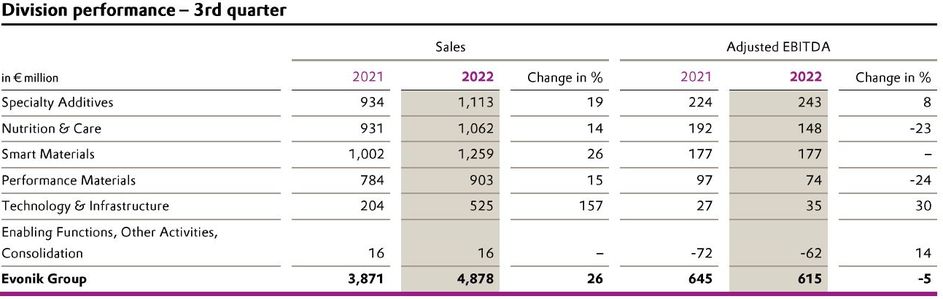

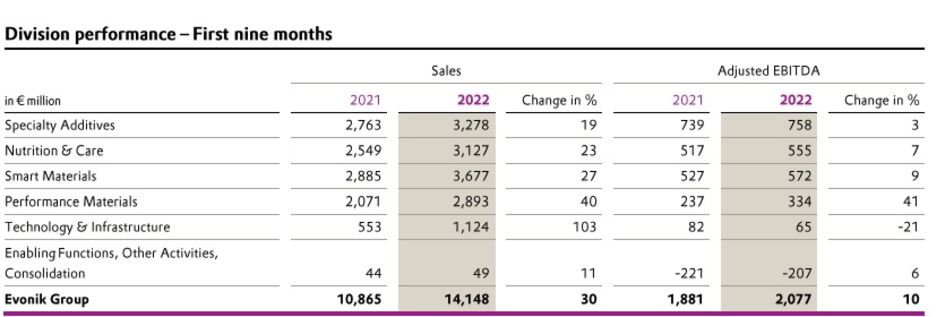

Specialty Additives:

In the Specialty Additives division, sales rose 19 percent to

€1.11 billion in the third quarter on noticeably higher selling prices due to the passing on of higher variable costs and favorable currency effects. Sales volumes declined. Products for the construction and coatings industries, as well as for renewable energies, achieved noticeably higher sales as a result of successful price increases to compensate for increased costs. Sales of additives for polyurethane foams and consumer durables also increased, mainly due to higher prices. Sales volumes for additives for the automotive sector were slightly higher. Adjusted EBITDA rose 8 percent to €243 million, a robust performance in challenging times.

Nutrition & Care:

In the Nutrition & Care division, sales increased by 14 percent to €1.06 billion in the third quarter, also due to significantly higher selling prices and positive currency effects. Volumes declined, however, mainly due to lower demand for animal feed. With Health Care and Care Solutions clients, Evonik was able to expand sales thanks to continuing good demand for active ingredients from the cosmetics industry. Adjusted EBITDA fell by 23 percent to

€148 million.

Smart Materials:

Sales in the Smart Materials division grew 26 percent to

€1.26 billion in the third quarter. The increase resulted from significantly higher selling prices and positive currency effects at stable volumes. Inorganic products generated noticeably higher sales thanks to significantly higher selling prices to pass on the higher variable costs. Sales in the Polymers business unit were also noticeably higher than in the previous year for the same reasons. Sales volumes were almost stable in both units.

At €177 million, adjusted EBITDA was on par with last year.

Performance Materials:

In the Performance Materials division, sales rose 15 percent to €903 million in the third quarter amid declining volumes. Compared to the very strong second quarter, the situation for products of the C4 network normalized, with sales increasing slightly as a result of improved prices. Sales of superabsorbents rose significantly based on higher selling prices. Adjusted EBITDA declined by 24 percent to €74 million due to lower product margins.

Company information

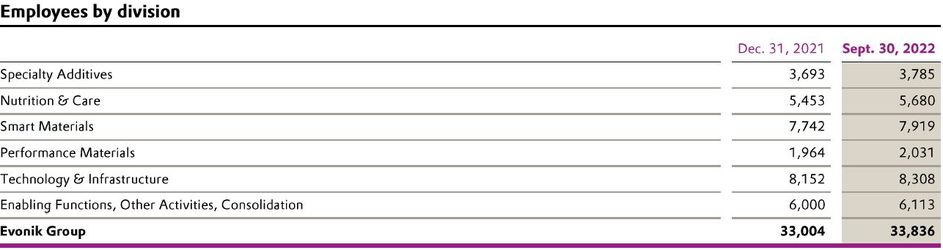

Evonik is one of the world leaders in specialty chemicals. The company is active in more than 100 countries around the world and generated sales of €15 billion and an operating profit (adjusted EBITDA) of €2.38 billion in 2021. Evonik goes far beyond chemistry to create innovative, profitable and sustainable solutions for customers. About 33,000 employees work together for a common purpose: We want to improve life today and tomorrow.

Disclaimer

In so far as forecasts or expectations are expressed in this press release or where our statements concern the future, these forecasts, expectations or statements may involve known or unknown risks and uncertainties. Actual results or developments may vary, depending on changes in the operating environment. Neither Evonik Industries AG nor its group companies assume an obligation to update the forecasts, expectations or statements contained in this release.