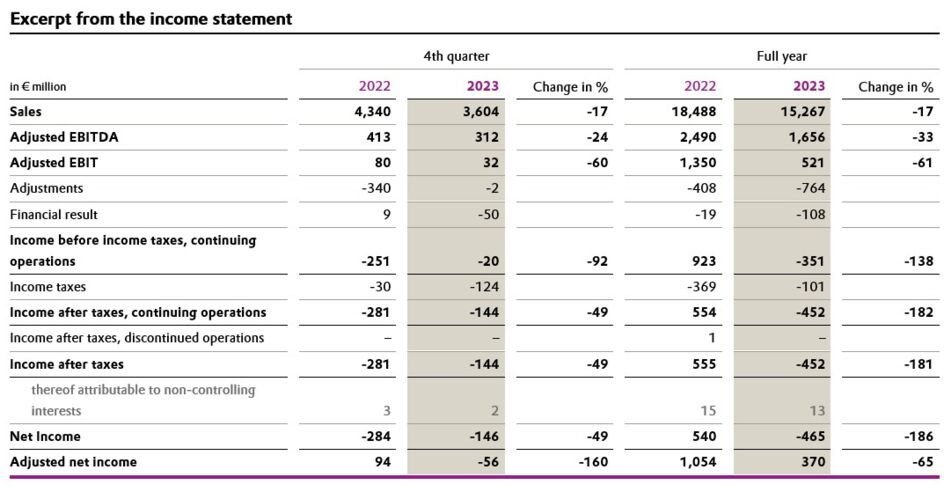

Evonik meets 2023 forecast, expects higher profit in 2024

- 2023 adjusted EBITDA of €1.66 billion, sales of €15.3 billion

- Outlook 2024: Adjusted EBITDA between €1.7 billion and €2.0 billion

- Target structure for "Evonik Tailor Made" program in place: Fewer management levels, faster decisions

Essen, Germany. Evonik met the 2023 forecast the company had reduced in the summer, despite a continuously challenging environment. The specialty chemicals company's adjusted EBITDA amounted to €1.66 billion, within the targeted range of between €1.6 billion and €1.8 billion. Group sales fell by 17 percent to €15.3 billion, also within the targeted range of €14 billion to €16 billion.

"The many crises around the world have put a damper on our results," says Christian Kullmann, Chairman of the Executive Board. "Overall, we got away with a black eye. We owe this above all to the great efforts of all our employees. However, the general conditions will not get any easier, which is why we will continue our fundamental revamp of the Group."

The focus on liquidity management proved very successful. Free cash flow in 2023 amounted to €801 million ─ even higher than in the previous year ─ thanks to prudent management of net working capital and strict investment discipline. The cash conversion rate, the ratio of free cash flow to adjusted EBITDA, reached a strong 48 percent. In 2022, it was 32 percent. Payments for investments in property, plant and equipment were reduced to

€793 million in 2023, compared to €865 million in 2022.

Evonik also achieved its 2023 savings target of €250 million by through measures to safeguard earnings.

"In difficult times, the first order of business is to keep the money together," says Maike Schuh, Chief Financial Officer of Evonik. "We have retained our ability to act. This was painful at times, but it was also successful. We will therefore continue these measures in the current year."

The Executive Board will propose to the Annual Shareholders' Meeting on June 4 an unchanged annual dividend of €1.17 per share. This corresponds to a highly attractive dividend yield of around 7 percent. "Dividend continuity is crucial for our long-term investors," says Schuh. "Our healthy free cash flow allows us to remain true to our reputation as a top dividend stock even in a difficult environment."

Volumes sold reflected the unfavorable conditions. They fell by 8 percent in 2023. Selling prices declined by 3 percent. Evonik reported a net loss of €465 million in 2023 due to exceptionally high impairments and burdens from structural measures, most of which occurred by September 30. In the previous year, Evonik reported a net income of €540 million.

Evonik does not expect an economic recovery during 2024. Hence, capital expenditures will be limited to around €750 million. The company expects an increase in adjusted EBITDA to a range between €1.7 billion and €2.0 billion, with sales between €15 billion and €17 billion. The cash conversion rate should be around 40 percent.

"We must not delude ourselves, even if there are slight signs of a recovery: What we are currently experiencing are not cyclical fluctuations, but massive, consequential changes of our economic environment," says Kullmann. "We are addressing this challenge with the 'Evonik Tailor Made' program which will change our organizational structure for good."

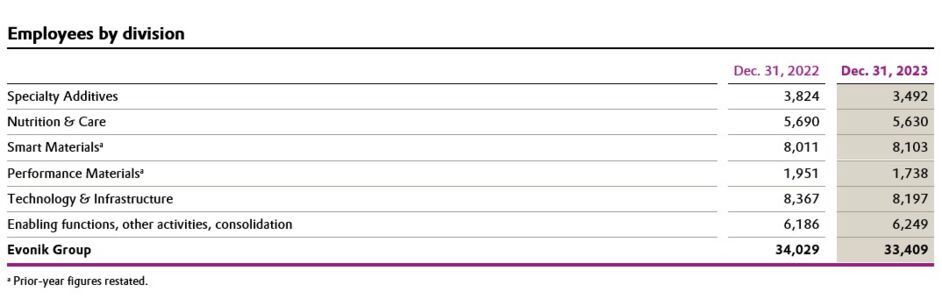

The first phase of ‘Evonik Tailor Made’ has been completed. All structures and processes of the company have been analyzed extensively over the past months. Based on this analysis, Evonik will design and establish a new organizational structure by the end of 2026. Evonik aims to do without administrative activities that do not directly support its businesses. At the same time, key tasks will be consistently bundled in the new structure. The number of hierarchical levels below the Executive Board will be reduced to a maximum of six, while review and approval procedures will be significantly accelerated. Group-wide, managers will then lead a median of seven direct reports, compared to the current span of control of one to four.

As a result, Evonik will become leaner, faster, and have a significantly reduced cost structure. Up to 2,000 jobs will be cut worldwide, including a disproportionate number of management positions. The majority of these adjustments, around 1,500 jobs, will be made in Germany. Evonik expects cost reductions of around €400 million annually after the program’s completion in 2026. Around 80 percent of these savings will derive from personnel reductions, the rest will come from lower material costs. First effects of ‘Evonik Tailor Made’ should materialize in the current year already.

"We have chosen our own, tailor-made path for Evonik without external consultants to achieve the best possible results," says Thomas Wessel, Chief Human Resources Officer and Labor Director. "It is clear that our company will look very different in two years ─ much more dynamic and efficient. We will achieve this in the fair manner Evonik is known for: focused on joint goals and respectful in our dealings with each other."

In the coming weeks, the Executive Board and the co-determination bodies will negotiate how the planned job cuts will be executed in a socially responsible manner.

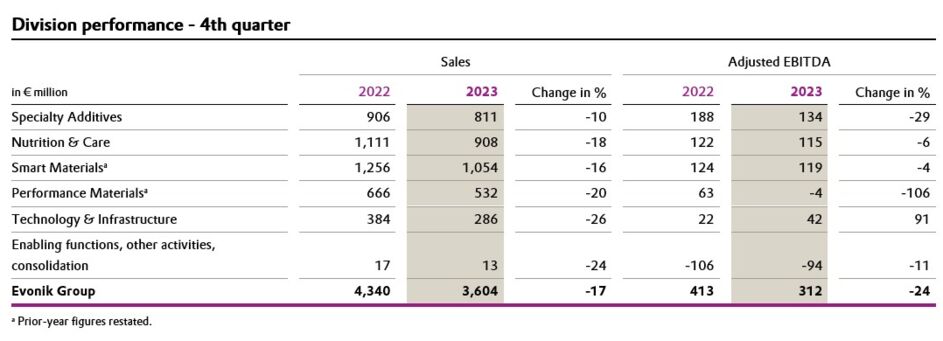

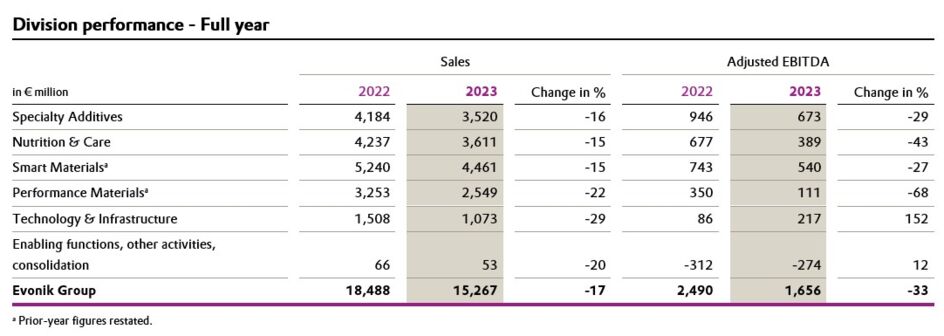

Development in the chemical divisions

Specialty Additives:

The Specialty Additives division's performance in 2023 was impacted by weak demand and a noticeable reduction in customer inventories. This resulted in underutilization of plant capacity and the associated pressure on margins. Sales fell by 16 percent to €3.52 billion, primarily due to noticeably lower volumes and negative currency effects. Prices remained stable. Demand for products for the construction and coating industries declined in all regions. Sales of additives for polyurethane foams and consumer durables decreased because of lower volumes and a slight drop in prices. Additives for the automotive sector suffered a sales volume decline while prices held stable. Adjusted EBITDA at the division fell by 29 percent to €673 million. The adjusted EBITDA margin fell from 22.6 percent in the previous year to 19.1 percent in 2023.

Nutrition & Care:

In the Nutrition & Care division, sales fell by 15 percent to €3.61 billion, mainly due to lower prices in the Animal Nutrition business and negative currency effects. Animal Nutrition recorded significantly lower prices for essential amino acids, but the downward trend slowed in the second half of the year. Sales volumes increased slightly. Overall, Animal Nutrition's sales remained significantly below the previous year. In Health & Care, revenue declined due to lower volumes despite a slight improvement in prices. Active cosmetic ingredients performed well, while demand for pharmaceutical lipids for use in mRNA-based vaccines declined. Adjusted EBITDA at the division fell 43 percent to €389 million. At 10.8 percent, the adjusted EBITDA margin was below the level of the same period in the previous year (16.0 percent). In response to the weak performance, Evonik adjusted the operating model for amino acids at the beginning of the year, which already yielded noticeable positive effects in 2023. Total savings of around €200 million should materialize by 2025.

Smart Materials:

Sales in the Smart Materials division fell by 15 percent to €4.46 billion due to a noticeable drop in demand and negative currency effects. Prices remained stable. Inorganic products achieved significantly lower sales because of declining demand in almost all market segments. While environmentally friendly specialty applications for hydrogen peroxide developed positively, production facilities in Asia were temporarily idled due to lackluster demand. While silicas for the automotive industry saw a stable trend, demand was weaker in other end markets. High-performance polymers recorded both higher prices and volumes,supported by new production capacities. Adjusted EBITDA at the division decreased by 27 percent to €540 million. Earnings were also negatively impacted by a planned maintenance shutdown for the high-performance plastic polyamide 12. At 12.1 percent, the adjusted EBITDA margin was below the previous year (14.2 percent).

Performance Materials:

Sales in the Performance Materials division fell by 22 percent to €2.55 billion. The previous year included full annual sales for the site in Luelsdorf, Germany, which was sold on June 30, 2023. The business with products from the C4 chain saw declining volumes and significantly lower prices. As a result, sales decreased significantly. Sales of superabsorbents were also down due to lower demand from Europe. Adjusted EBITDA at the division fell by 68 percent to €111 million. The adjusted EBITDA margin fell from 10.8 percent in 2022 to 4.4 percent in 2023.

Further information

Company information

Evonik is one of the world leaders in specialty chemicals. The company is active in more than 100 countries around the world and generated sales of €15.3 billion and an operating profit (adjusted EBITDA) of €1.66 billion in 2023. Evonik goes far beyond chemistry to create innovative, profitable, and sustainable solutions for customers. More than 33,000 employees work together for a common purpose: We want to improve life today and tomorrow.

Disclaimer

In so far as forecasts or expectations are expressed in this press release or where our statements concern the future, these forecasts, expectations or statements may involve known or unknown risks and uncertainties. Actual results or developments may vary, depending on changes in the operating environment. Neither Evonik Industries AG nor its group companies assume an obligation to update the forecasts, expectations or statements contained in this release.