Share

Shareholder structure

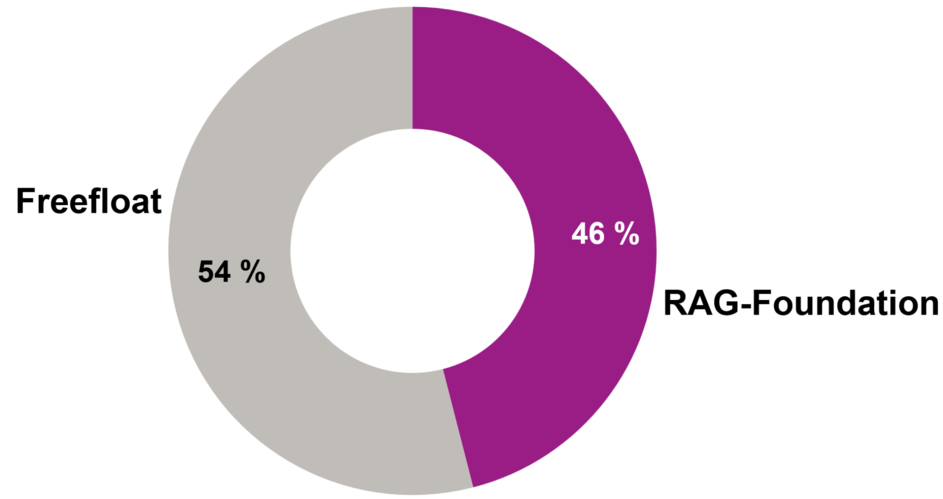

Shareholder structure of Evonik Industries AG

Annual press conference of RAG-Stiftung, June 11, 2024

Quote Bernd Tönjes, chairman of the RAG-Stiftung:

"The foundation will remain the largest shareholder and a strong anchor shareholder, currently holding just under 47% of the shares in Evonik. Anticipating your question about when we will part with further shares: The long-term goal was and is to sell the stake in Evonik in a share price-sensitive manner; in the long-term perspective to 25.1%, which we hold in fixed assets. How close we are already to this goal becomes clear when you consider that we currently still have exchangeable bonds with a volume of €2 billion outstanding. This corresponds to a further almost 20% of Evonik shares that we hold for a possible exchange at maturity. If you have now done the math, you will find that there is not much missing from the aforementioned 25.1% and thus the much-cited "overhang" no longer exists."

RAG-Stiftung

RAG-Stiftung manages a portfolio of around €20 bn assets under management (AUM) to finance/cover the perpetual liabilities arising from hard-coal mining in Germany. In terms of AUM, “RAG-Stiftung” is amongst the biggest foundations in Europe. The portfolio consists of publicly traded securities, private equity, direct holdings, infrastructure investments, real estate and bonds of various types. RAG-Stiftung focuses on investments with high total shareholder return and strong cash/distribution profiles. More than 65 % of the total portfolio are invested in assets other than Evonik. RAG-Stiftung has a strong interest in Evonik’s profitable growth, resulting in significant shareholder returns and a clear intention to remain a significant shareholder of Evonik as an integral part of its portfolio.

Contact & Service

Contacts in the Investor Relations Department

Disclaimer